Drafting the Foundational Agreement - The LLP Deed or Trust Agreement

From idea to investment-ready. Navigating the legal landscape with confidence.

Welcome back to our series on critical documentation for Alternative Investment Funds (AIFs). In Part 1, we examined the Private Placement Memorandum (PPM) — the definitive disclosure and offer document. In this instalment, we turn to the legal instrument that constitutes the AIF's existence: the Trust Deed or LLP Agreement.

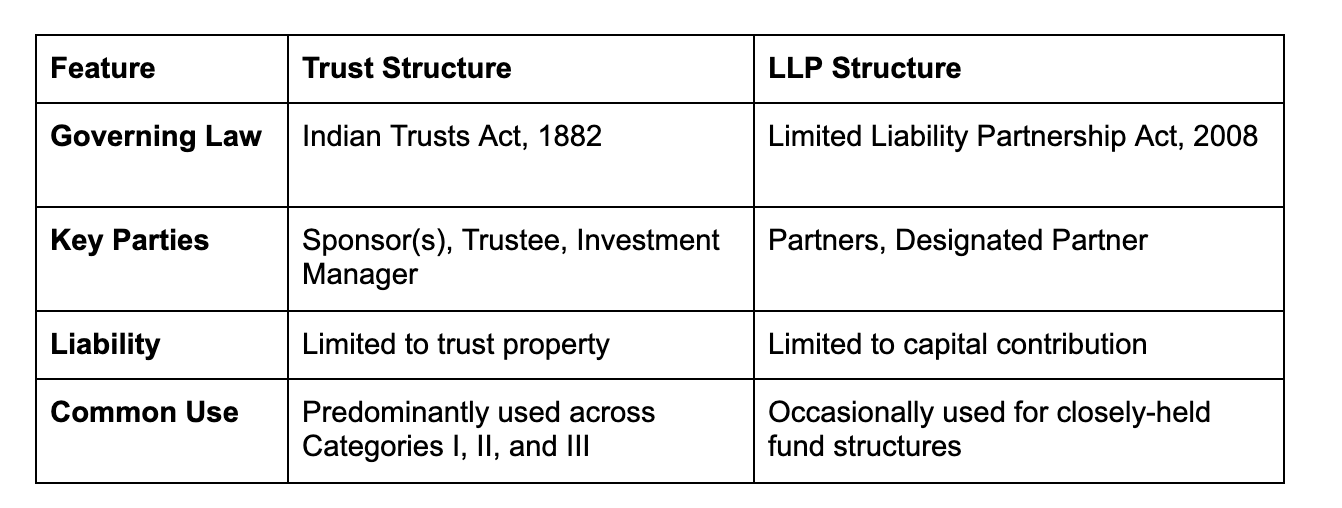

The legal structure chosen for the AIF, whether a Trust or a Limited Liability Partnership (LLP), governs the rights, obligations, and fiduciary relationships among the stakeholders. The foundational agreement formalises this structure, setting forth the fund's governance framework and operating procedures in accordance with the SEBI (AIF) Regulations, 2012.

Determining Legal Form: Trust vs. LLP

The sponsor must first determine the appropriate legal vehicle for the fund. Each structure carries distinct implications in terms of governance, liability, taxation, and regulatory compliance.

This structural choice determines the legal drafting style, the allocation of fiduciary duties, and the specific governance mechanics that will be embedded in the foundational agreement. For instance, in a Trust structure, fiduciary responsibility lies primarily with the Trustee, who holds legal title to the assets and ensures the Manager acts in the best interest of beneficiaries. The Trust Deed typically separates ownership and control, with the Sponsor establishing the Trust and the Manager operating under a mandate. Conversely, an LLP structure sees all investors become partners, with fiduciary oversight centralized in the Designated Partner, often the Sponsor or Manager. The LLP Agreement, in this case, incorporates detailed provisions for partner rights, liability limitations, and governance procedures akin to a corporate shareholder agreement. These distinctions directly affect compliance requirements, operational workflows, and investor interactions.

Essential Provisions of the Foundational Agreement

Irrespective of structure, the foundational agreement must conform to regulatory requirements and industry standards. Below are the primary components that must be addressed:

1. Identity and Duration: Name, Investment Objective, Tenure

The agreement should specify the fund’s legal name, its defined investment strategy (e.g., "growth equity in mid-market Indian companies"), and its proposed term, typically including initial duration and conditions for extensions. These must be consistent with disclosures in the PPM and the application filed with SEBI.

2. Capital Framework: Commitments and Drawdowns

This section must comprehensively define the mechanism by which capital commitments are made and drawdowns are effected via capital call notices. It must also ensure compliance with minimum corpus requirements as prescribed by SEBI:

General AIFs: ₹20 crore

Special Situation Funds: ₹100 crore (Chapter 6, Para 6.1)

Sponsor’s continuing interest: Minimum of ₹5 crore or 2.5% of corpus, whichever is lower (Regulation 10(d))

3. Distribution Economics: The Waterfall

This clause defines the fund’s profit-sharing mechanics. It must set out the priority of distributions, including return of capital, preferred return (hurdle rate), and carried interest payable to the Manager. The clause must be meticulously drafted to ensure alignment with the economics disclosed in the PPM.

4. Governance Architecture: Duties and Powers

This section allocates authority and responsibility among key stakeholders:

Manager/Sponsor: Must outline investment discretion, fee structures (management and performance), and restrictions. Must also include appointment of a Compliance Officer (Ch. 13, Para 13.1.1) and identification of Key Management Personnel (Ch. 13, Para 13.1.2).

Trustee/Designated Partner: Charged with oversight and ensuring the Manager’s compliance with fiduciary obligations.

Investors: Must set out investor rights (e.g., voting thresholds for material amendments) and obligations (e.g., capital call compliance, restrictions on transfer).

5. Procedural Mechanics: Meetings and Voting

The governance section should establish procedures for convening meetings, notice periods, quorum requirements, and voting methodology. Voting is typically aligned with capital contribution rather than equal vote per investor.

6. Termination and Liquidation Protocol

The winding-up clause must detail the procedures for liquidation of assets, distribution of residual proceeds, and compliance with SEBI norms. Where required, provisions for in-specie distribution and formulation of a Liquidation Scheme (Chapter 23) must be included.

Conclusion: A Foundational Legal Instrument

The Trust Deed or LLP Agreement is more than a formality. It is the authoritative source for the fund’s legal, operational, and economic structure. Precision in drafting, adherence to SEBI regulations, and alignment with investor expectations are imperative. Legal counsel with AIF-specific experience is indispensable to ensure compliance and avoid downstream litigation or regulatory exposure.

Previous post: Private Placement Memorandum (PPM): The Anchor Document for Every AIF

Reference: SEBI Master Circular May 7, 2024

Disclaimer: This post aligns with the provided SEBI Master Circular dated May 07, 2024. SEBI regulations are subject to change, and this should not be construed as legal advice. Always consult with a qualified legal professional or SEBI-registered intermediary for advice tailored to your specific circumstances.