Private Placement Memorandum (PPM): The Anchor Document for Every AIF

Welcome to the first installment in our deep-dive series on essential documentation for setting up an Alternative Investment Fund (AIF) in India. If you're building an AIF, there's one document that sets the tone for everything: the Private Placement Memorandum (PPM).

This isn't just paperwork. The PPM is your anchor document. It outlines your strategy, establishes your compliance posture, and communicates your proposition to investors with clarity and legal precision.

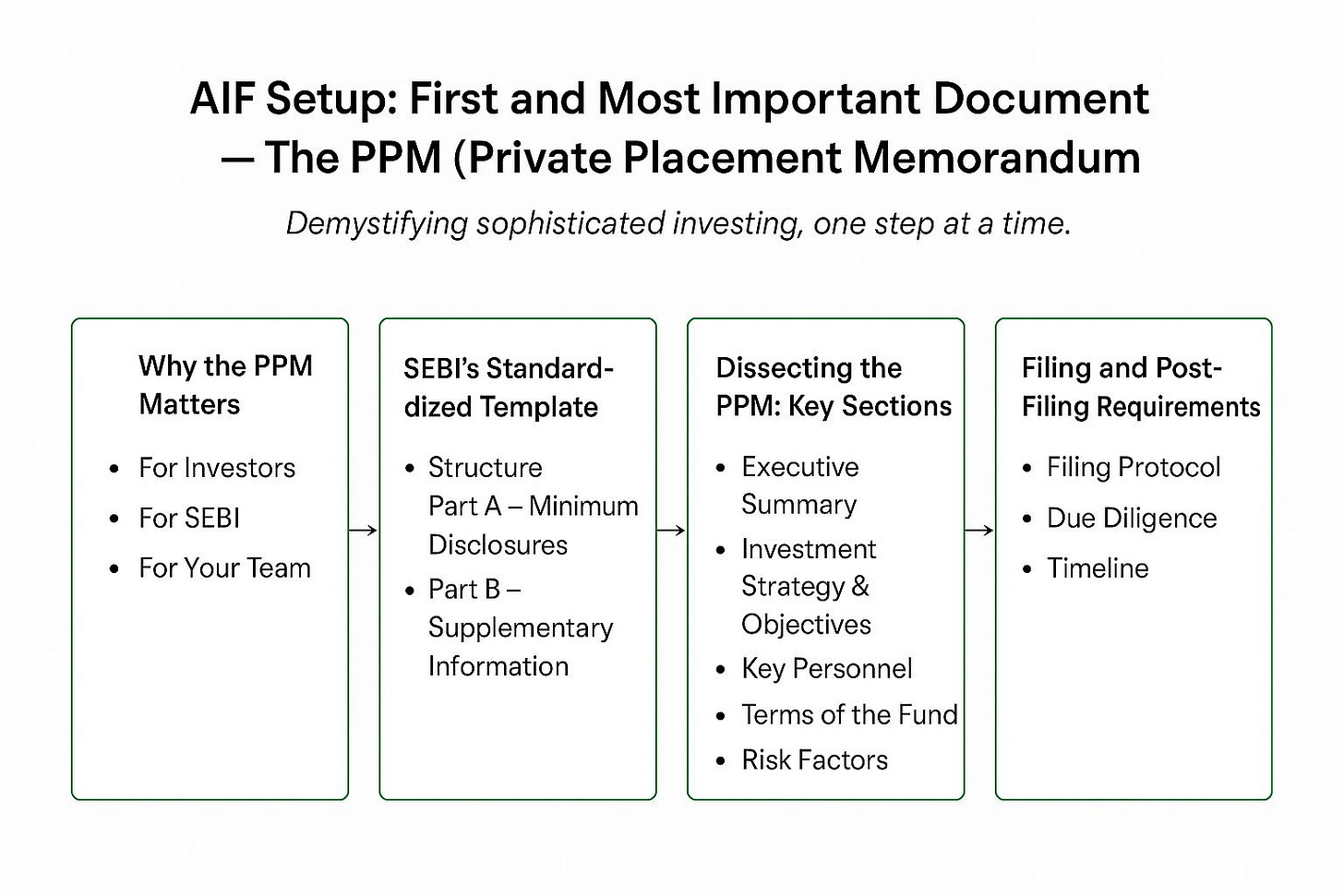

Why the PPM Matters

For Investors:

The PPM is the definitive source of information for evaluating your fund. It demonstrates your seriousness and fosters trust by laying out the opportunity, risks, and operating mechanics in detail.

For SEBI:

A properly structured and filed PPM is a regulatory requirement. It reflects adherence to the framework set out by SEBI and must follow the format detailed in the latest Master Circular.

For Your Team:

Internally, the PPM is a north star. It aligns your investment, operations, legal, and compliance teams around clearly defined principles and procedures.

A well-crafted PPM signals maturity and preparedness. A weak or non-compliant one raises concerns for investors and regulators alike.

SEBI’s Standardized Template

To improve disclosure standards, SEBI now mandates the use of a specific PPM template for Category I and II AIFs. This is outlined in Annexure 1 of the Master Circular.

Structure:

Part A – Minimum Disclosures: Mandatory sections that must be disclosed without exception.

Part B – Supplementary Information: Optional, but useful for providing additional details relevant to the fund.

Dissecting the PPM: Key Sections

Below is a breakdown of the most critical sections in line with SEBI’s requirements. We illustrate each with examples from a sample fund: Suraj India Tech Fund, a hypothetical Category II AIF.

1. Executive Summary

The opening snapshot of your fund. This must be precise, direct, and concise.

Inclusions:

Fund name and structure (Trust/LLP/Company)

Category and sub-category

Investment objective

Target corpus

Key team members

SEBI Requirement: Clear, high-level overview for prospective investors.

Example:

"The Suraj India Tech Fund is a SEBI-registered Category II AIF targeting ₹250 Crore. The fund will invest in 15–20 early-stage Indian B2B SaaS and fintech startups, led by a team with over two decades of experience in technology investing."

2. Investment Strategy & Objectives

Your thesis, market, and playbook. This is where specificity matters.

Inclusions:

Sector focus

Geography

Stage of investment (e.g., Series A)

Cheque sizes

Ownership targets

Co-investment approach

SEBI Requirement: Regulation 9(2) requires investor approval (2/3 by value) for any material strategy change.

Example:

"The fund will deploy ₹10–20 Crore per company for a 15–20% equity stake in B2B SaaS businesses based in Bangalore, Pune, and Hyderabad, with minimum ARR of ₹50 Lakh. Suraj will typically lead the round."

3. Key Personnel

This is where you build credibility.

Inclusions:

Bios of fund managers, principals, and advisors

Investment track record

Designation of Compliance Officer

SEBI Requirement: Chapter 13 mandates disclosure of all Key Management Personnel (KMP) and notification to SEBI of any change. Compliance Officer must not be the CEO.

4. Terms of the Fund

The mechanics that underpin investor returns.

Inclusions:

Target corpus

Minimum investment (₹1 Crore; lower for accredited investors)

Fees (management and carried interest)

Tenure and extension terms

Distribution waterfall

SEBI Requirement: Chapter 2 mandates a detailed, tabular breakdown of fees and a waterfall example.

5. Risk Factors

Sophisticated investors expect transparency.

Inclusions:

Market risks

Sector-specific risks (e.g., tech obsolescence)

Regulatory risks

Key-person risk

Fund-specific risks

SEBI Requirement: Include five-year disciplinary history and litigation details for the AIF, sponsor, manager, directors/partners, and trustees. Tax disputes over ₹5 lakh must also be disclosed (excluding personal matters).

6. Legal and Compliance Structure

Administrative clarity is a sign of professionalism.

Inclusions:

Fund structure and governing law

Trustee and custodian roles

Conflict-of-interest policy

Grievance redressal process

Investor Charter

SEBI Requirement: Chapter 17 requires including the Investor Charter and historical investor complaint data.

Filing and Post-Filing Requirements

Filing Protocol:

As per Regulation 12(2), the PPM must be filed through a SEBI-registered Merchant Banker. Self-filing is not permitted.

Due Diligence:

Merchant Banker must independently verify all disclosures and file a due diligence certificate (Annexure 3). They must not be affiliated with your AIF, sponsor, or manager.

Timeline:

SEBI acknowledgment starts the 12-month clock. You must declare your First Close within this window, with a minimum committed corpus (₹20 Crore for most AIFs).

Annual Audit:

The fund must conduct an annual audit to verify compliance with the PPM. The audit report is to be submitted to SEBI and the Trustee/Sponsor within six months of financial year-end.

PPM Table of Contents

Template > https://www.sebi.gov.in/sebi_data/commondocs/dec-2019/Annexure_B_p.PDF

Confidentiality & Disclaimer

Executive Summary

Investment Strategy & Objectives

Risk Factors

Terms of the Fund (Fees, Expenses, Waterfall Examples)

Management Team (Bios + Disciplinary History)

Governance Structure (KMP, Investment Committee, Compliance Officer)

Investor Rights & Obligations

Conflict of Interest Policy

Grievance Redressal Mechanism & Investor Charter

Tax Considerations

Winding Up Process

Reference: SEBI Master Circular May 7, 2024

Disclaimer: This post aligns with the provided SEBI Master Circular dated May 07, 2024. SEBI regulations are subject to change, and this should not be construed as legal advice. Always consult with a qualified legal professional or SEBI-registered intermediary for advice tailored to your specific circumstances.