Your Final AIF Documentation & Filing Plan

Validate every step from idea to investment-ready before capital deployment

From drafting the PPM (Private Placement Memorandum) to operational agreements, you’ve finally made it to the AIF (Alternative Investment Fund) documentation pathway. Congratulations!

Knowing the “what” and “why” is half the battle; the real challenge is execution – doing things in the right order, with the right documents, by the right deadlines.

This post is your master checklist that consolidates the key actions from this series and SEBI’s rules for launching and running a compliant AIF in India.

How to Use This Checklist

Work through the phases sequentially.

Copy this into your project management tool.

Assign owners, due dates and artifacts for each action.

Phase 1: Pre-Application

Objective: Have your structure, rulebook and team ready before you approach SEBI.

1) Finalize Fund Structure

Choose legal form: Trust / LLP (Limited Liability Partnership) / Company

Deliverables: Draft Trust Deed / LLP Agreement / MOA (Memorandum of Association) & AOA (Articles of Association)

2) Draft the PPM (Your Rulebook)

Use SEBI’s prescribed PPM template: Annexure 1 (Category I/II), Annexure 2 (Category III)

Include all minimum disclosures; add a tabular fee example & distribution waterfall

Compile 5-year disciplinary history (AIF, sponsor, manager, directors/partners and trustee)

3) Initial Compliance Readiness

Confirm sponsor/manager fit & proper

Verify key investment team experience/qualifications

4) Appoint Key Advisor

Engage a SEBI-registered Merchant Banker (not an associate) to file the PPM and issue the due-diligence certificate

Phase 2: Application to SEBI

Objective: Submit a complete and compliant registration package.

Form A: Complete the primary application form

Attach: Executed structure documents, Draft PPM, Merchant Banker Due-Diligence Certificate (Annexure 3) and fee proof

File online: Submit via the SEBI Intermediary Portal (SI Portal)

Phase 3: Post-Approval

Objective: Stand up the operating basics after you receive the registration certificate.

Open bank accounts: Scheme-wise, segregated accounts only in the AIF’s name

Apply for PAN (Permanent Account Number) for the AIF entity

File the final PPM (incorporate SEBI comments) through the Merchant Banker

Phase 4: Pre-Launch

Objective: Put guardrails in place before you invest.

Appoint a Custodian: Execute the agreement before the first investment

Transition relief: Existing Category I/II schemes with corpus ≤ ₹500 Cr (and at least one investment as of Jan 12, 2024) must appoint by Jan 31, 2025

Investment Management Agreement (IMA): AIF ↔ Manager; ensure full consistency with the PPM

Declare “First Close”:

Deadline: within 12 months of SEBI’s communication taking the PPM on record

Corpus: meet minimums (e.g., ₹20 Cr for most AIFs; ₹100 Cr for SSFs (Special Situations Funds))

Sponsor/Manager commitment: cannot be reduced post first close

Phase 5: Fundraising

Objective: Legally onboard investors and secure commitments.

Subscription Agreements for each investor (must not go beyond/contradict the PPM)

KYC (Know Your Customer) / AML (Anti-Money Laundering) for all investors; eligibility checks (FATF/IOSCO/MoU where applicable)

Side Letters (if any): Only if consistent with the PPM and not prejudicial to other investors

Capital Calls: Issue notices when funds are required for investments and fees

Phase 6: Operational

Objective: Maintain compliance with scheduled reporting and documentation.

A) Annual PPM Audit

Audit compliance with PPM terms (internal or external auditor/legal professional)

Submit findings to Trustee/Sponsor and to SEBI within 6 months from FY end

B) Quarterly Reporting

File standardized quarterly reports on SI Portal (SEBI Intermediary Portal) within 15 days of each quarter end

Include investor complaints data via SCORES (SEBI Complaints Redress System) if received, resolved or pending

C) CTR (Compliance Test Report)

Prepare CTR in Annexure 12 format

Submit to Trustee/Sponsor within 30 days of FY end

D) Units Dematerialisation (Investors’ Units)

Issue all units in demat form per corpus-based timelines

If investors lack demat details, use an Aggregate Escrow Demat Account

E) Investments Dematerialisation (AIF Portfolio Securities)

All investments made on or after July 1, 2025 must be held in dematerialised form

For certain earlier investments, demat by Oct 31, 2025 (limited exemptions, e.g., schemes ending by that date)

F) Valuation & Benchmarking

Appoint an Independent Valuer meeting SEBI eligibility; calculate NAV (Net Asset Value)

Provide required performance data to SEBI-registered benchmarking agencies under the AIF benchmarking framework

G) Material Changes

For any material change (e.g., fee changes, or change in sponsor/manager), follow the prescribed process, including exit options for dissenting investors where applicable

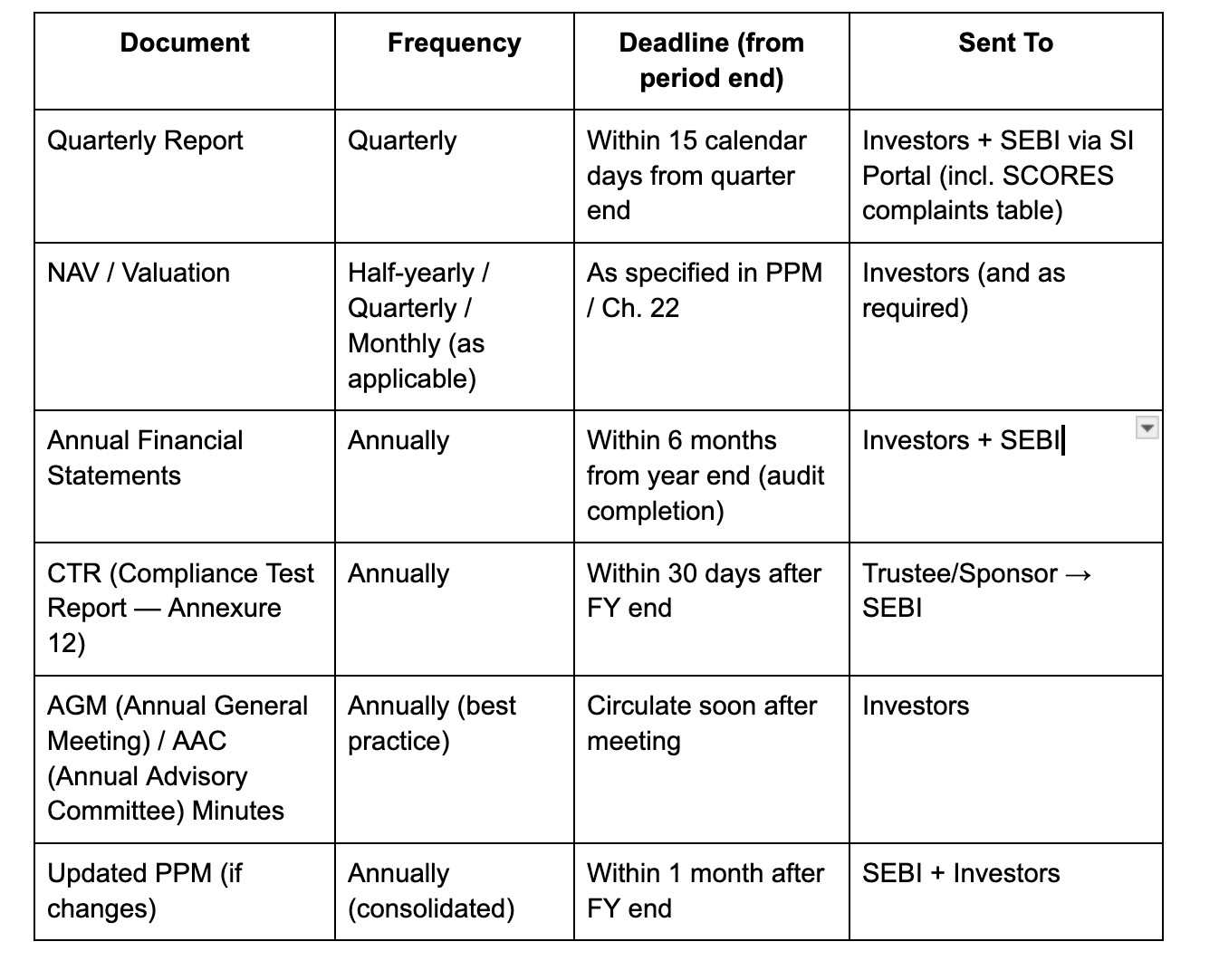

Quick Reference to Annual Compliance Cycle

Final Word

Regulations evolve. Bookmark SEBI’s site and watch for circulars. Build a reliable team and treat this checklist as your operating playbook.

Execute meticulously, stay transparent and focus on what matters most - delivering returns for your investors.