SEBI Issues Clarification on Digital Accessibility Requirements for Regulated Entities (REs)

Circular link: https://www.sebi.gov.in/legal/circulars/dec-2025/clarification-on-the-digital-accessibility-circulars-of-sebi_98238.html

The Securities and Exchange Board of India (SEBI) has issued a fresh circular on December 08, 2025, providing important clarifications on earlier digital accessibility directives. This update is critical for all Regulated Entities (REs) — including AIFs, intermediaries, stock exchanges, depositories, mutual funds, portfolio managers, and others — who operate investor-facing digital platforms.

1. Background: Strengthening Digital Accessibility

SEBI had previously released three circulars (July 31, August 29, and September 25, 2025) focusing on ensuring inclusive, accessible digital platforms across the securities market ecosystem.

The latest clarification reinforces the regulator’s commitment to “Investors’ Right to have digital accessibility”, now mandated to be included in all Investor Charters for relevant entities.

2. Key Compliance Requirements for REs

a. Extended Timeline for Accessibility Auditor Appointment

Instead of appointing an accessibility auditor by December 14, 2025, REs must now submit a detailed status report on their accessibility readiness for each digital platform by March 31, 2026.

This update offers more time while ensuring continued progress on compliance.

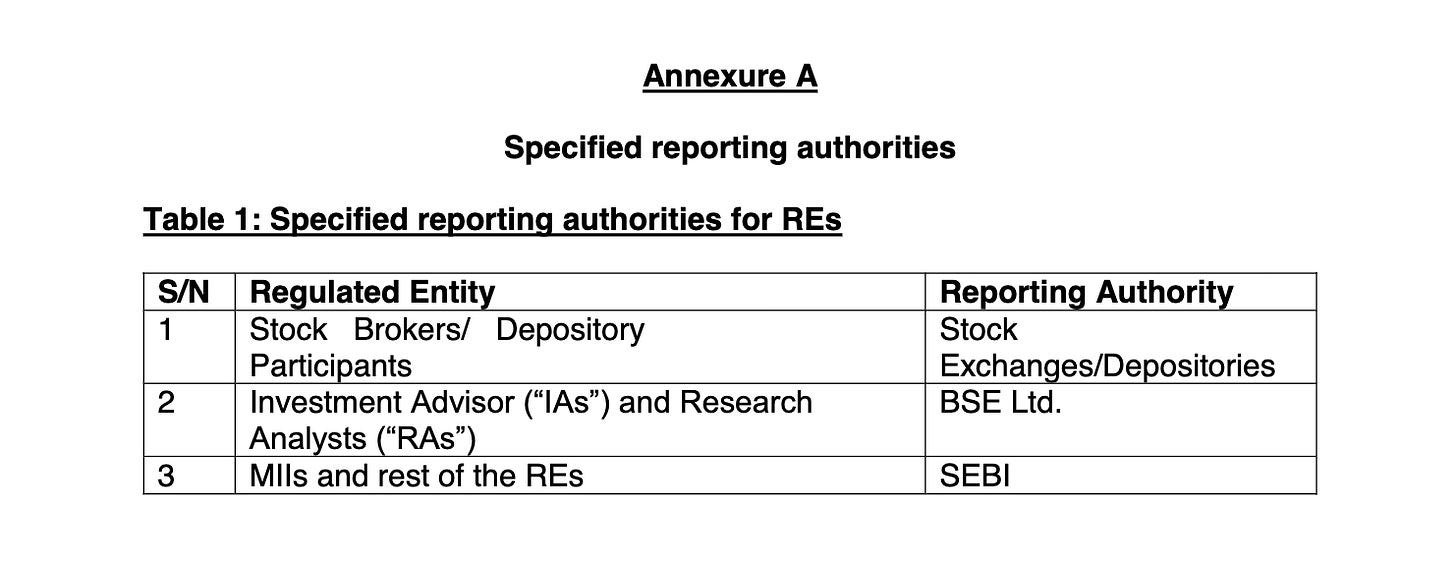

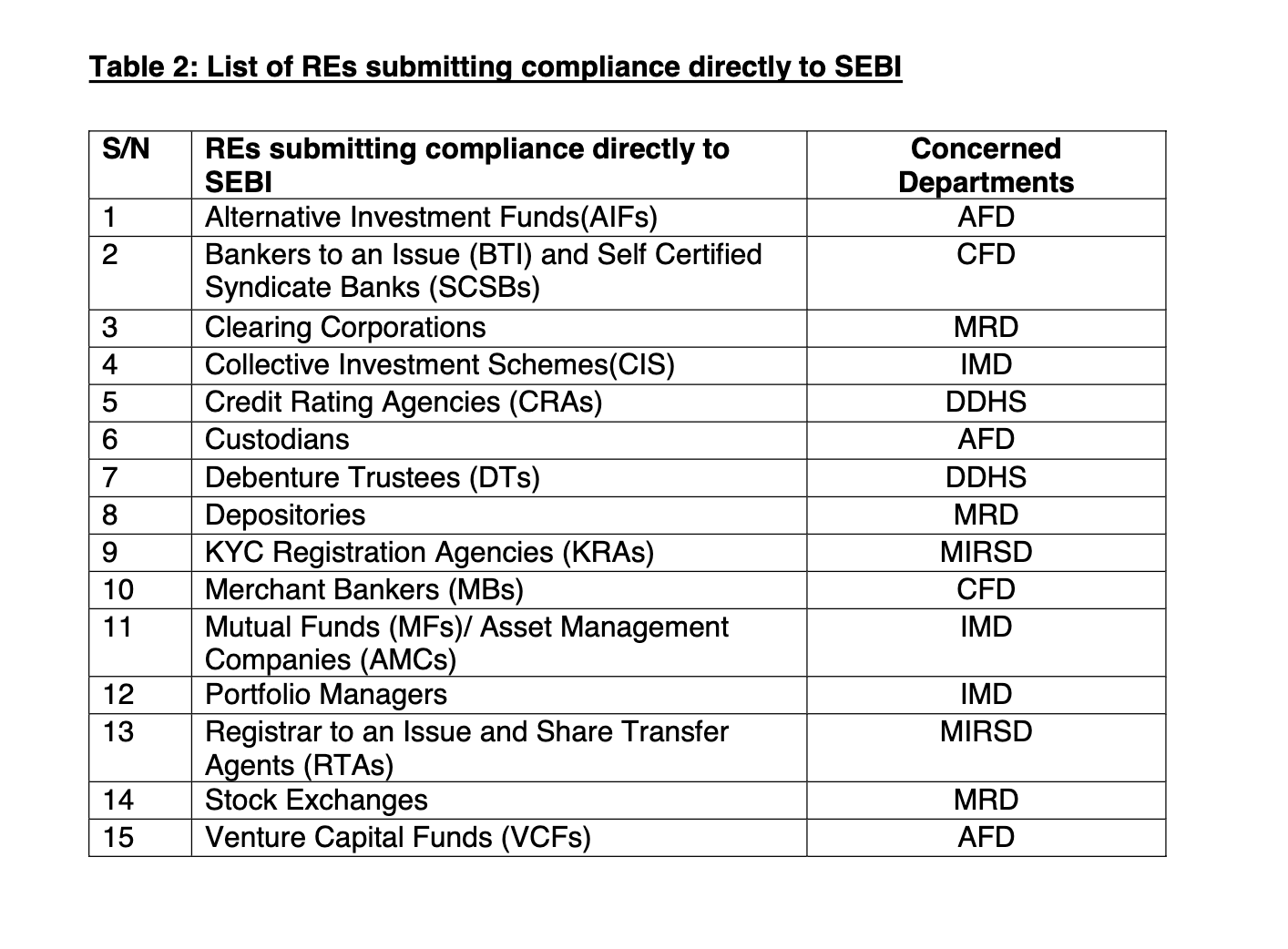

Reports must be submitted to the respective reporting authorities listed in Annexure A (see below). REs reporting directly to SEBI must email their submissions to digital_acc@sebi.gov.in.

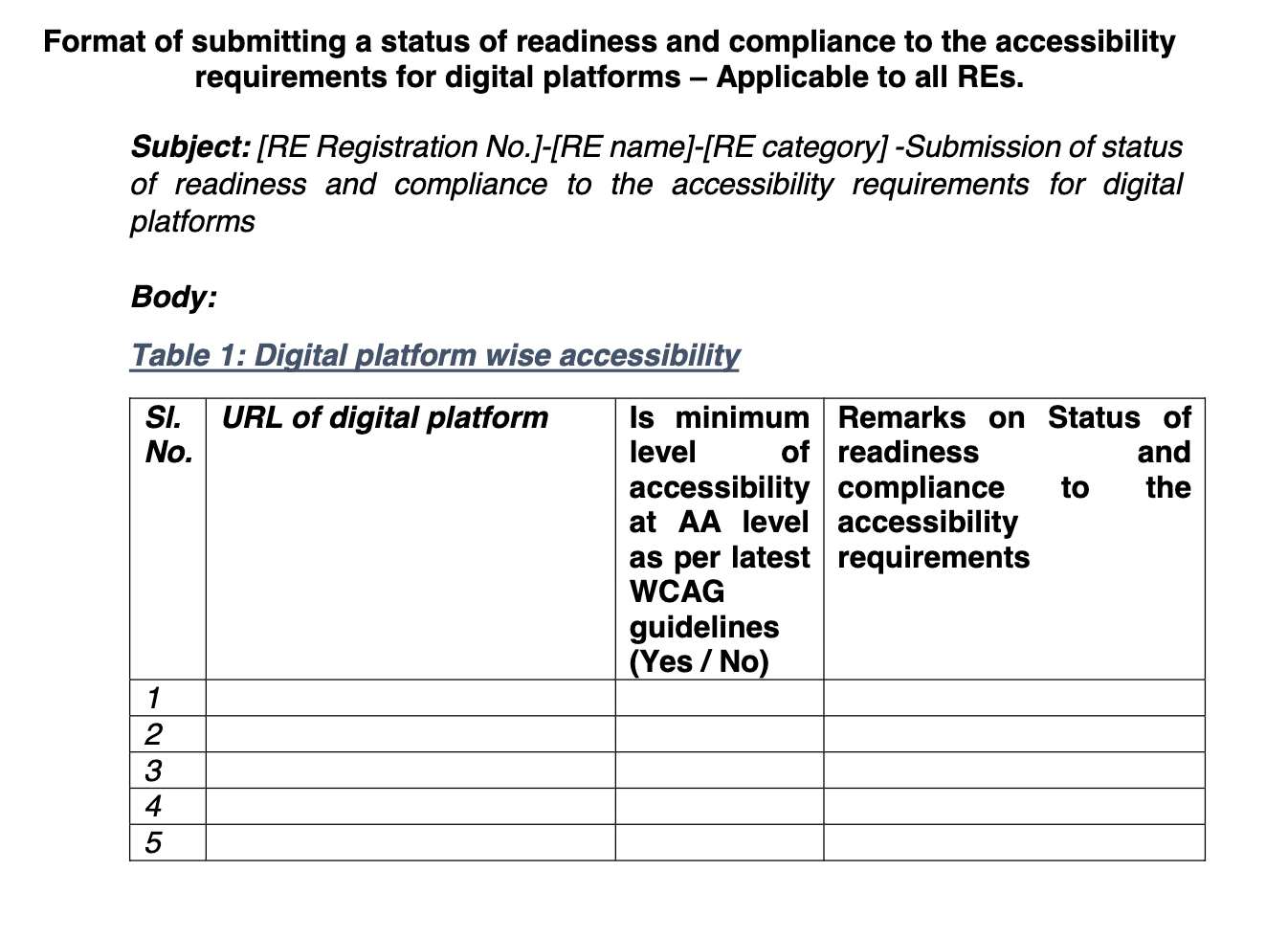

b. Mandatory Submission Format (Annexure B)

SEBI has provided a standardized format for reporting readiness and compliance, covering:

Platform URLs

Whether WCAG AA-level compliance is met

Detailed remarks on readiness and gaps

This ensures uniformity and simplifies the review process.1765194149704

c. Investor Complaint Mechanism for Accessibility Issues

Investors who face accessibility challenges on any RE digital platform can now raise complaints using the “Accessibility” category on SCORES.

REs must resolve such issues to close the complaint — strengthening accountability and investor protection.

d. Mandatory Periodic Accessibility Audits

All REs must conduct regular accessibility audits on their websites, mobile apps, and portals using certified accessibility professionals.

This ensures sustained compliance and continuous improvement over time.

3. Reporting Authorities

4. Annexure B: Format for Accessibility Compliance Report

5. Purpose of This Circular

Issued under SEBI Act Section 11(1), the circular aims to:

Protect investor interests

Promote inclusive digital access

Ensure uniform compliance across all digital infrastructure in the securities market

It also emphasizes SEBI’s increasing focus on accessibility as a core investor right.

Conclusion

SEBI’s latest clarification underscores the growing importance of digital accessibility in the Indian securities market.

For REs — including AIFs, intermediaries, and market infrastructure institutions — this is a crucial reminder to accelerate accessibility initiatives and ensure compliance by March 31, 2026.