Post-Launch Protocol – Your AIF Ongoing Reporting Cycle

The essential compliance framework that keeps SEBI and investors happy

Congratulations! Your Alternative Investment Fund is set up, the rulebook (Private Placement Memorandum or PPM) is filed and the first capital is in the bank. You are past launch.

Not quite done, though. Launching the fund is only the beginning. The next crucial phase is maintaining trust with investors and with the Securities and Exchange Board of India. You build this trust with consistent transparency and clear communication.

Think of your fund as an ongoing enterprise. Like any well-run enterprise, it needs regular checkups and reports to show it is on track. These documents create a continuous cycle.

This guide breaks down the key reports you should produce on schedule to keep the fund compliant, investors informed and operations smooth.

Why this reporting cycle is your secret weapon

This is not a bureaucratic hassle. It is your chance to:

Demonstrate performance with clear facts

Build credibility through consistent reporting

Manage expectations and avoid surprises

Stay compliant and avoid penalties

The pillars of ongoing reporting

SEBI sets a framework for ongoing disclosures. These three core documents anchor your cycle:

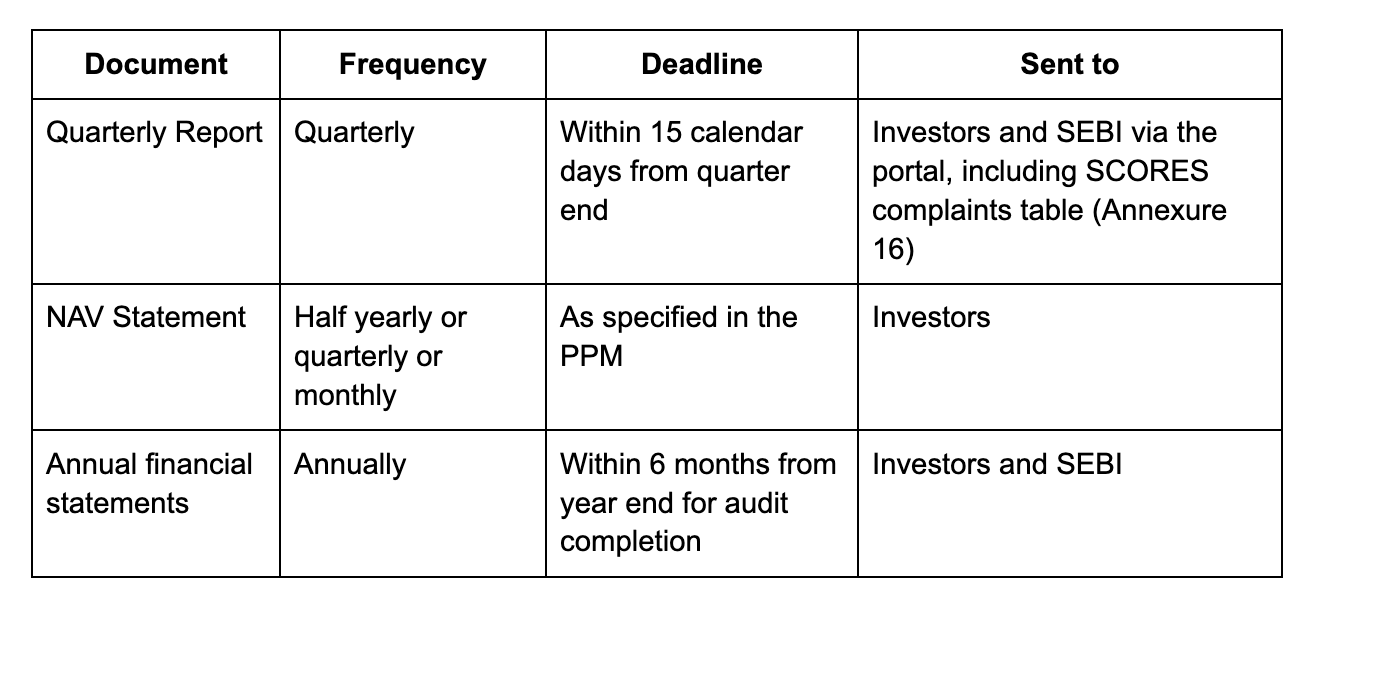

1. The Quarterly Report

Your primary tool for regular communication. It is a concise snapshot of the last three months.

It must include:

Portfolio update: all new investments in the quarter by company, amount and sector

Performance commentary: plain language narrative on results, winners, challenges and market conditions

Cash flow summary: capital called, investments and expenses

Top holdings: largest positions by value

Complaints summary as per Annexure 16: investor grievances received directly and via SEBI’s SCORES platform, resolved and pending

Manager’s commentary tip: add one short section that explains the why behind the numbers and sets context for the next quarter.

2. The NAV Statement

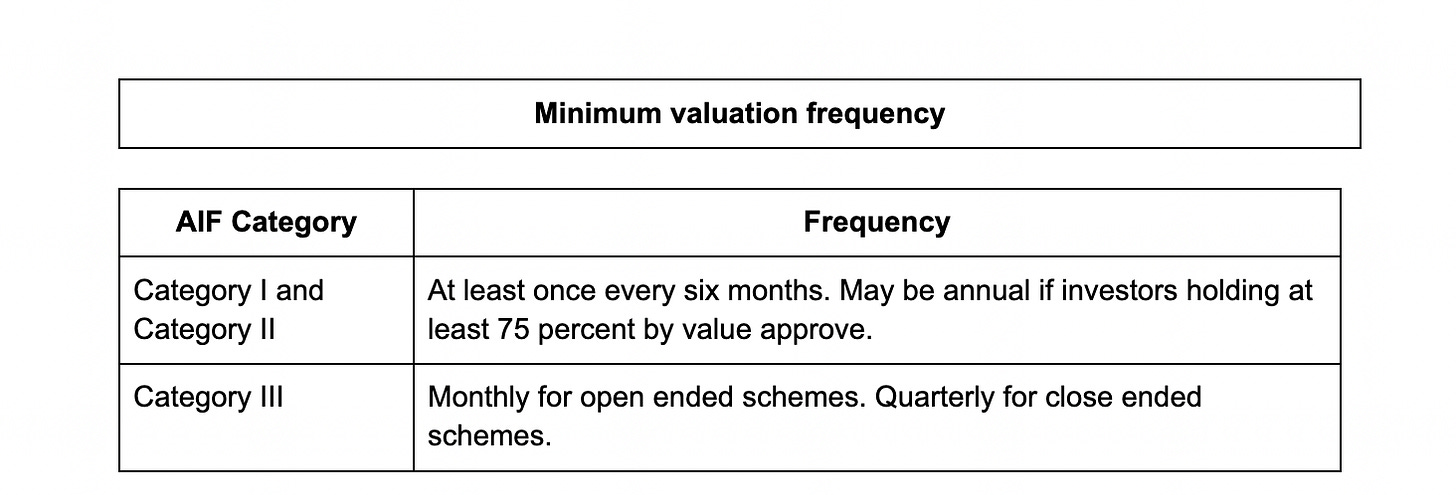

Net Asset Value is the per-unit value of the fund. The statement is simple: valuation date and NAV per unit. The valuation itself must be performed by an independent valuer using SEBI’s approach in Chapter 22 of the Master Circular.

3. The Annual General Meeting minutes

Holding an annual meeting or an annual advisory committee meeting is a best practice. The minutes are the authoritative record.

The required documents are as followed:

Attendance of investors and presenters

Performance review covering annual financial statements and audited results

Strategy discussion for the coming year, risks, and priorities

Key decisions and approvals, if any

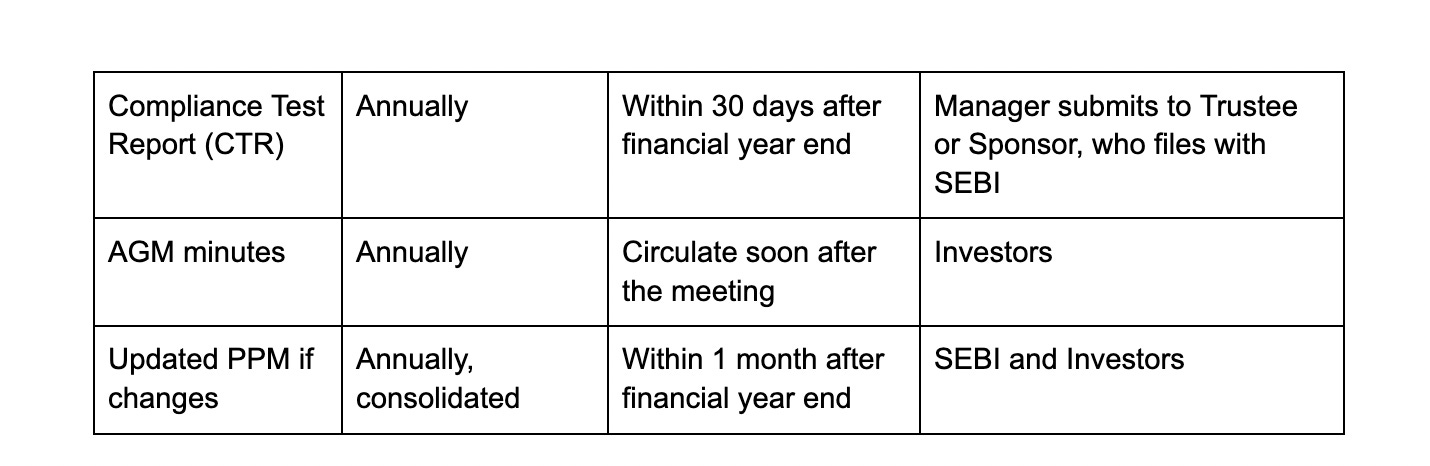

Compliance Test Report review: the manager prepares the CTR as per Annexure 12. Discuss the findings for full transparency.

Quick Reference to Your Annual Compliance Cycle

Deadlines below are measured from the end of the relevant period.

One line summaries

Quarterly Report: portfolio changes, cash flows, commentary and complaints

NAV Statement: per-unit value based on independent valuation

AGM minutes: audited results, strategy, key decisions and CTR discussion

Transparency is your advantage

In the AIF your reputation is your most valuable asset. Use this reporting cycle as a strategic commitment. Consistent, clear and honest communication shows integrity and professionalism. It helps you retain current investors and win future ones.