IFSCA Updates V-CIP Rules: What Changes for Digital KYC & Remote Onboarding

The International Financial Services Centres Authority (IFSCA) has issued a major refresh to its AML/CFT and KYC framework, introducing a modernised standard for Video-based Customer Identification (V-CIP). These changes strengthen digital onboarding, deepen regulatory clarity, and open new pathways for compliant remote onboarding — including a pilot for low-risk NRI customers.

This update replaces Annexure II (Part-A) for V-CIP of Indian nationals and introduces a structured path for NRI V-CIP. The circular is effective immediately.

🧠 Why it matters

As fintechs, banks, wealth managers, and fund platforms expand globally, secure remote onboarding has become foundational. The new V-CIP norms strike the balance between:

✅ Stronger AML/CFT safeguards

✅ Data sovereignty & cybersecurity

✅ Real-world usability for financial institutions

✅ Customer-friendly digital onboarding

🏛 Key Policy Updates at a Glance

1. Expanded definition of who can conduct V-CIP

V-CIP can now be performed by:

The RE (regulated entity)

A supervised financial group entity in India

A KRA (KYC Registration Agency)

This creates a unified digital KYC pipeline across India’s regulated ecosystem.

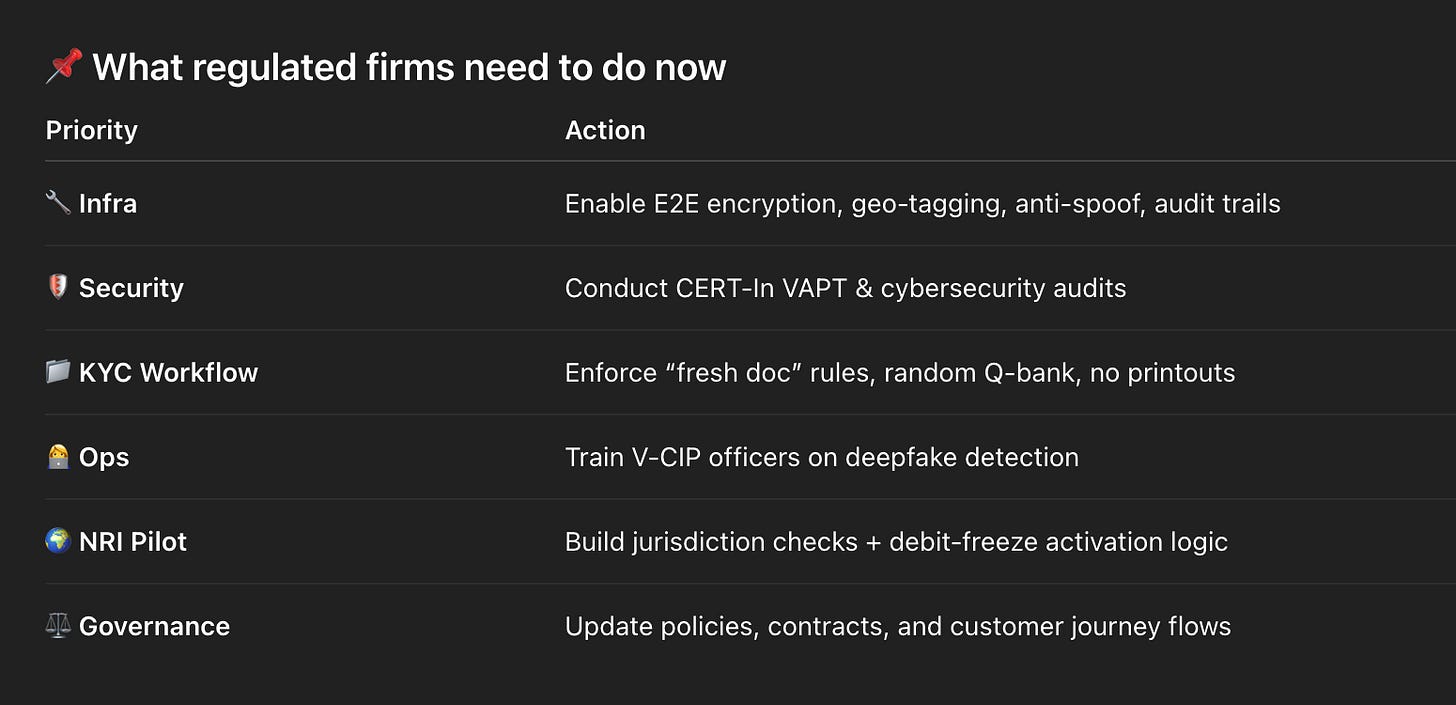

2. Strong security & data governance controls

The V-CIP system must:

Comply with IFSCA cyber security norms

Use end-to-end encryption

Block VPN/proxy/IP spoofing

Capture live geolocation and timestamps

Implement liveness, anti-spoof, and anti-deepfake checks

Move all V-CIP data immediately to RE/Group servers

(Cloud allowed, but no retention outside the regulated environment)

Data sovereignty and privacy — front and centre.

3. Operational & compliance standards

All V-CIP officers must be trained

Random questioning + prompting = automatic rejection

Call drop = new session

KYC docs must be fresh (≤ 3 working days)

Only verified digital docs allowed (DigiLocker/e-PAN etc.)

Aadhaar must be masked

Activation only after concurrent audit

This elevates V-CIP to a rigorously audited process, not just a video call.

4. New NRI V-CIP pilot

IFSCA has opened a controlled pilot for low-risk NRIs, limited to select jurisdictions including the US, UK, UAE, Singapore, Canada, Australia, EU, etc.

Key safeguards:

IP must match the declared foreign residence

Verified bank account in that jurisdiction required

Account opens in debit-freeze mode

Fully activated only after first credit confirmation

This is India’s first structured regulatory path toward global remote onboarding from major financial centres.

👀 Bigger picture

IFSCA continues to position IFSC-GIFT City as a globally compliant yet innovation-forward financial hub. With the new V-CIP framework, India’s regulatory stack moves closer to global digital-identity standards seen in Singapore, UAE, and Europe — while preserving data sovereignty and trust.

For fintechs, investment platforms, fund managers, and cross-border wealth players, this is a big unlock.