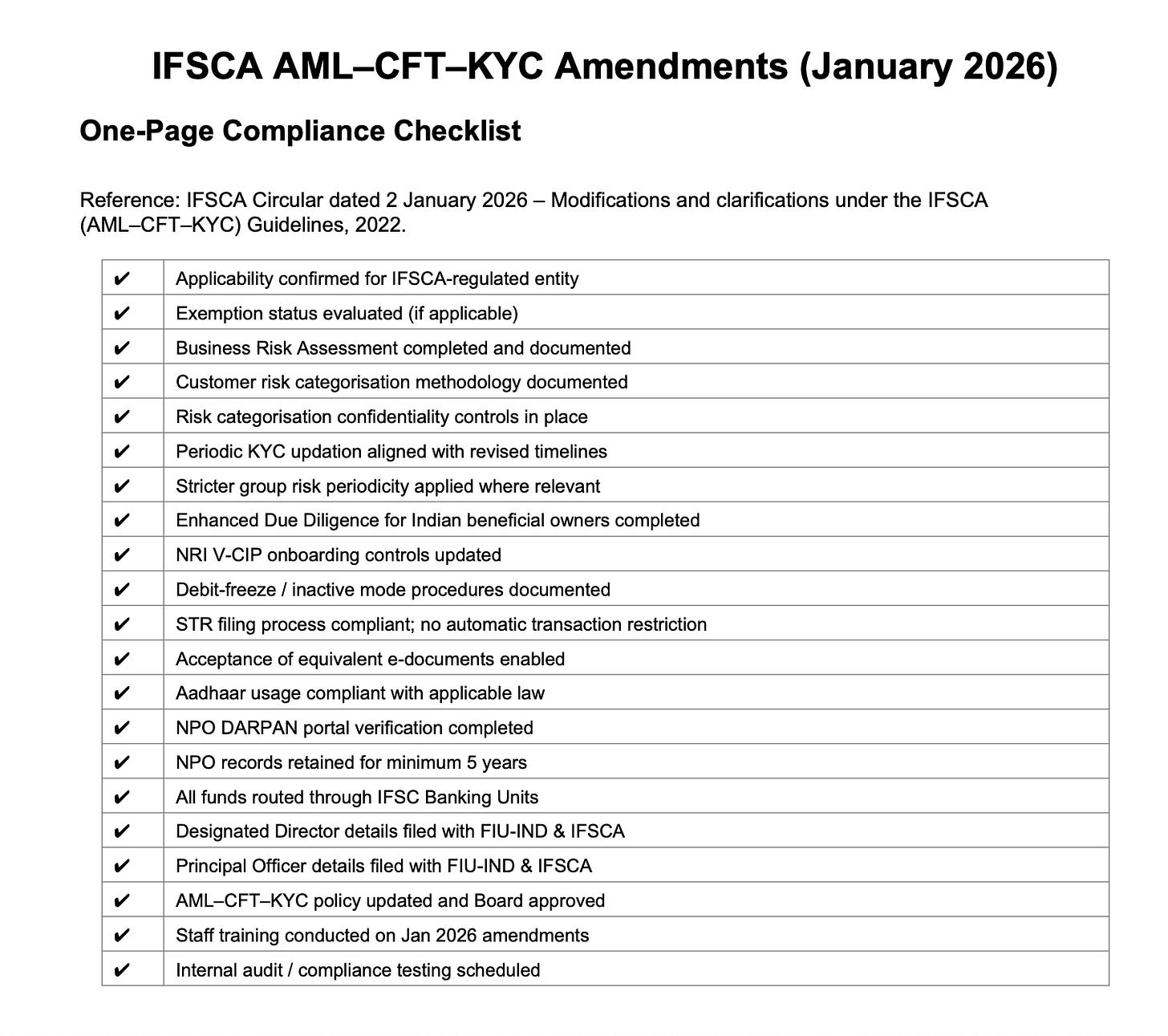

IFSCA AML–CFT–KYC Guidelines: Amendments & Clarifications (January 2026)

The International Financial Services Centres Authority (IFSCA) has issued an amendatory circular dated 2 January 2026, introducing multiple modifications, clarifications, and consolidations to the IFSCA (Anti Money Laundering, Counter-Terrorist Financing and Know Your Customer) Guidelines, 2022.

These changes are effective immediately and apply to all regulated entities operating in IFSCs, subject to specific exemptions.

1. Applicability of AML–CFT–KYC Guidelines

The Guidelines now explicitly apply to every regulated entity licensed, recognised, registered, or authorised by IFSCA, unless specifically exempted.

IFSCA retains the discretionary power to exempt any activity or regulated entity, in full or in part, from applicability of these Guidelines.

2. Newly Introduced Exempted Entities

IFSCA has consolidated exemptions previously issued through circulars and formally embedded them into the principal Guidelines.

The following entities / activities are exempted, subject to conditions:

Global-in-House Centres (GICs)

International Branch Campuses (IBC) and Offshore Education Centres (OECs)

Financial Crime Compliance Services Providers

Financial institutions providing services only to group entities located in non-FATF high-risk jurisdictions

Important:

Even exempt entities must:

Conduct and document a Business Risk Assessment

Continue AML–CFT compliance where risks are identified

3. Confidentiality of Customer Risk Classification

Regulated entities must ensure that:

Customer risk categorisation and underlying reasons remain confidential

Such information is not disclosed to customers, to avoid tipping-off

This aligns IFSC practices with global AML standards.

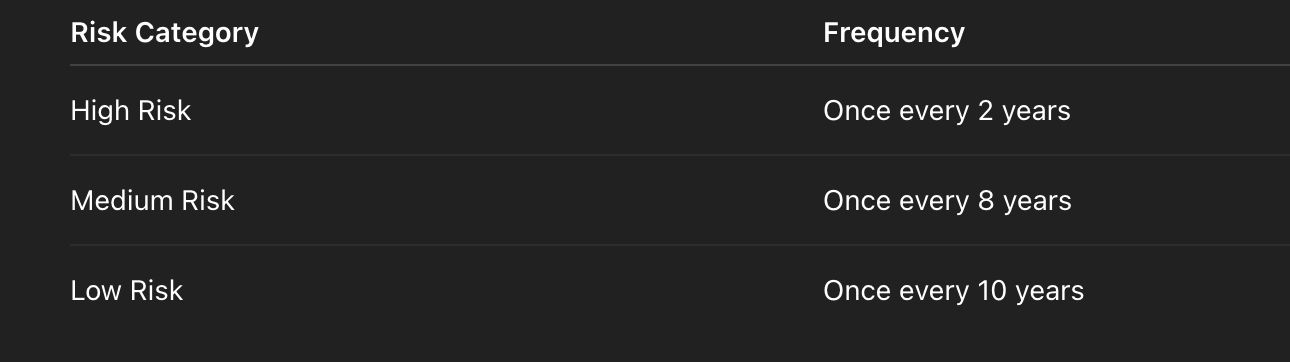

4. Periodic KYC Updation – Alignment with Indian Financial Groups

For resident Indian customers with an existing relationship within an Indian financial group, periodic KYC updation shall follow:

Where risk classification differs, the stricter periodicity applies.

5. Enhanced Due Diligence for Indian Beneficial Owners

To mitigate round-tripping risks, IFSCA has clarified that where:

The beneficial owner is an Indian national, and

The customer is a non-resident entity

Regulated entities must:

Ascertain source of funds

Apply Enhanced Due Diligence, irrespective of assigned risk category

6. NRI Onboarding via V-CIP

Key clarifications include:

Updated approved jurisdictions for low-risk NRI onboarding

Mandatory debit-freeze / inactive mode where address verification is pending

Clear communication to customers on activation procedures

7. Treatment of Suspicious Transaction Reports (STRs)

IFSCA has clarified that:

Transactions must not be restricted solely on account of STR filing

This ensures compliance actions remain proportionate and legally defensible.

8. Aadhaar, e-Documents & Digital KYC

The amendments:

Recognise equivalent electronic documents

Permit biometric-based e-KYC, including Aadhaar Face Authentication

Reiterate compliance with applicable Aadhaar laws

9. Non-Profit Organisations (NPOs)

For NPO clients:

DARPAN portal registration must be verified

Records must be retained for five years post relationship closure

10. Mandatory IFSC Banking Channel

All IFSC Financial Institutions must:

Route all monetary consideration exclusively through IFSC Banking Units